Whether you’re a recent college grad or few years into your career, starting life on solid financial ground can be difficult, which is why budgeting for young professionals is so important.

Let’s face it, many embark on a new career with low starting salaries, variable income, and with the gig economy and influencer rates constantly in flux, managing finances can feel daunting. But budgeting is especially crucial because—it provides stability, flexibility, and peace of mind.

No matter where you are in your career budgeting is a key factor in creating long-term financial stability. That’s why taking a few actionable steps now, can have a lasting impact on your money later.

- Start by Understanding Your Income (Including the Unpredictable Parts)

As a young professional, you may have an entry-level salary, freelance gigs, or occasional project fees. Start by identifying all your income streams, whether it’s your main job, freelance assignments, or any side hustles you may have. For those with irregular income, budgeting with irregular income is essential. Look at a few months’ average or use the lowest-earning month as your baseline. Planning for the minimum is a safety net, helping you budget even in leaner times and leaving extra income available for savings when times are better. - Track Every Dollar (Including All Those Work-Related Expenses)

Young professionals often juggle multiple expenses that directly support their work, such as subscriptions, transportation for meetings, or professional memberships. For 2-3 months, record every dollar you spend using a budgeting app, a spreadsheet, or even pen and paper. Knowing your baseline will help you distinguish essential work expenses from personal spending and identify where to scale back if needed. - Prioritize Financial Goals That Support Your Career

Budgeting for young professionals may not be easy in the beginning, especially if you’re on a tight budget. Setting financial goals in your 20s and 30s helps create good financial habits that extend far past your early career years. When you’re making what feels like pennies, it may be hard to set some aside for savings. But if you can, you will always be glad you did. Especially for these three “buckets”:- Build an emergency fund: Aim to build enough savings to cover at least three months of living expenses. For many young professionals, an emergency fund is crucial in fields where job stability can fluctuate. This also provides a backup in case you want to make a change without something to fall back on. Having an emergency fund gives you options.

- Save for professional development: Whether it’s a conference, new equipment, training program, or coaching having funds ready for career growth opportunities outside what your employer offers, can help you progress faster. The theory is, it increases your skills which then gives you an opportunity to grow faster, increasing your salary.

- Consider longer-term goals: Maybe you want to work towards paying off student debt or saving for a sabbatical to work on a personal project. Writing down these goals and setting aside even a small amount can keep them top of mind.

- Use the 50/30/20 Rule, but Adapt It for Your Reality

For a practical budgeting structure, the 50/30/20 rule is a great starting point for young adults: 50% for essentials (rent, food, utilities), 30% for non-essential or flexible spending, and 20% for savings or debt repayment. However, it’s okay to modify it based on your situation. No matter where your income is at the moment, even putting 10% into savings is a great start. For those with unpredictable income, treat savings as a “must-have” so it becomes part of your essentials. - Take Advantage of Budgeting Tools to Simplify the Process

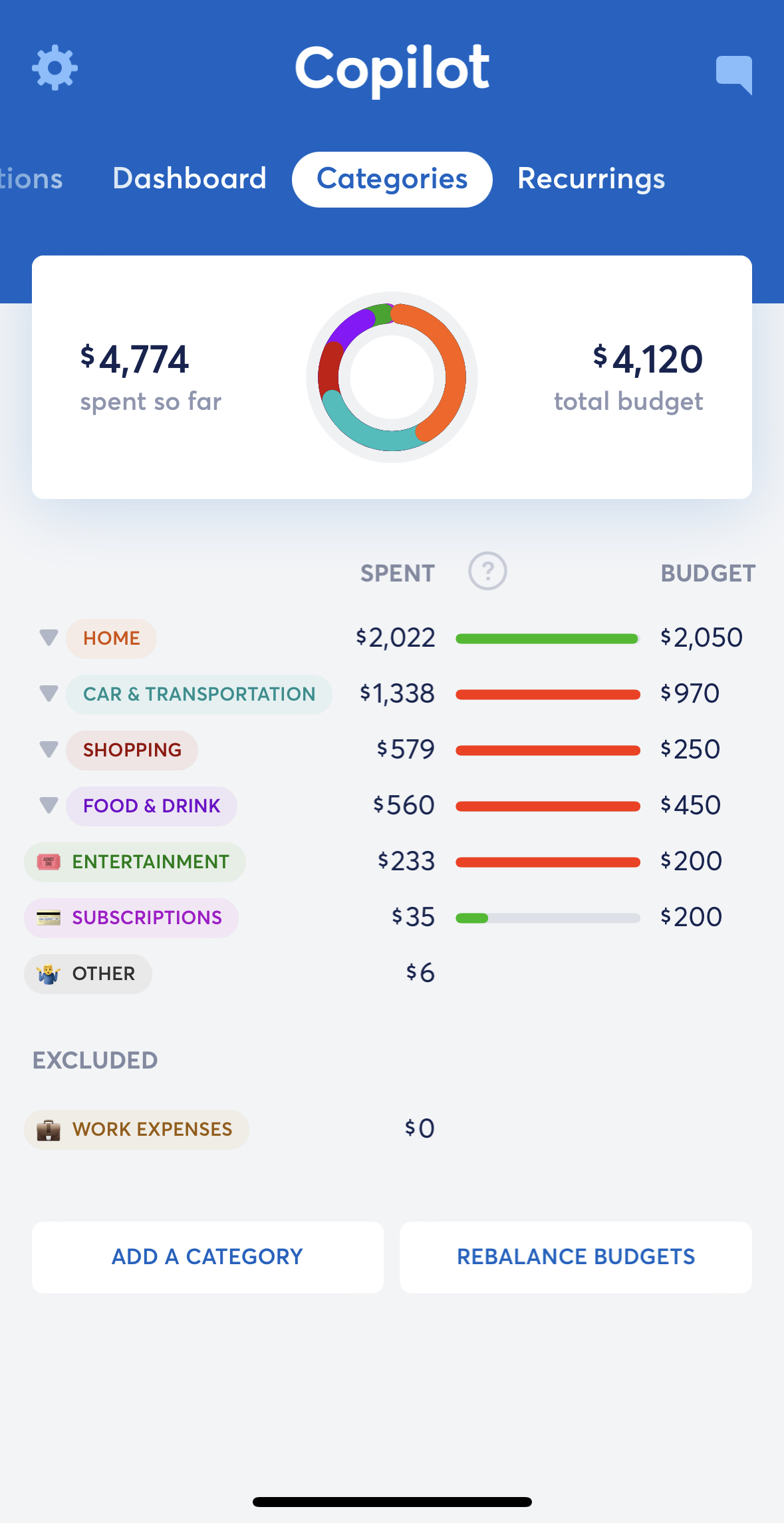

Apps like Copilot, PocketGuard, and YNAB (You Need a Budget) are some highly recommended budgeting tools for financial planning and sticking to a budget, as they can automate your tracking and provide insights into spending habits. Even a simple spreadsheet is useful for those who prefer manual tracking. I use both, an app for day-to-day tracking and a spreadsheet for future casting. This allows me to see more than a year in advance to see what type of financial situation we’ll be in. These tools are especially helpful for spotting patterns, showing how much you really spend on expenses or personal needs, and helping you stick to your budget. - Keep Your Budget Flexible and Review Regularly

Every month, reassess your plan. Life as a young professional isn’t always predictable—travel expenses, new projects, or freelance gigs might pop up unexpectedly. Unexpected travel, friend’s wedding, or other event may lead to an unexpected large expense. By reviewing and adjusting, you’ll stay on top of new income or changes in expenses. This flexibility lets you adapt to the ups and downs without losing track of your overall financial goals. - Advocate for Fair Pay and Don’t Underestimate the Power of Negotiation

While budgeting is critical, don’t lose sight of advocating for yourself and fair compensation. If you’re taking on more projects, working overtime, or consistently producing high-quality work, consider asking for a raise or a higher freelance rate. Negotiating for fair pay may feel daunting, especially early in your career, but every step toward fair pay is a step toward a more sustainable budget. There are also professional communities and support groups where you can find tips on how to negotiate for a higher salary in your field.

Budgeting is a Tool for Freedom and Security

Financial planning may not feel exciting, but budgeting for young professionals, is a step toward freedom. It provides the security that reduces stress, allows for fun and can have positive impacts for years or decades to come.

With a budget in place, you’ll be better equipped to handle income fluctuations, career shifts, and new opportunities. Start small, stay consistent, and view budgeting as a tool that lets you focus more on the life you love and advancing in your field.

I am not a financial professional. The information in this post is for informational purposes only. I may receive compensation from advertisements when you click on links to those products on this page.