Once we had kids, we knew it was time to a little more responsible and tackle the adulting things like start planning for the future. That’s why my wife and I knew we needed a family financial planner.

If you’re anything like me, the “future” means tomorrow, college, retirement and just about anything else.

So how do you plan for all of that at the same time?

It can be very overwhelming, especially with the cost of living at the moment. Everything just costs more, so how do you save at the same time?

In the nine years since the birth of our first child, we’ve had two financial planners.

The first was recommended to us by the person who helped us with our will. It was a cold introduction and overall the financial planner was good. However, for some reasons I’ll share below, it just didn’t work out.

My favorite budgeting app will help you save and plan all from your phone!

So we went looking for a new one and this time found success!

There are some financial planners that specialize in families but any financial planner can help, although it sure helps if they are parents too.

They understand the expenses, goals and realistic saving plans that you may need.

How to Pick Your Family Financial Planner

Here are five tips that will help you in finding your family financial planner.

1. Use Your Network

Picking a family financial planner is a very personal thing.

You need to find someone who understands your needs, wants and goals. Making sure personalities fit is key too.

They should feel like a cheerleader for you, not making you feel like you shouldn’t be spending. So asking around your network for suggestions is a great way to find possible planners.

When we were looking to switch financial planners, I went to my neighbor who happens to be a financial planner and asked for recommendations.

We joked that it would be awkward for him to be our planner but he spent some time thinking it over and came back with some suggestions and thoroughly explained why he believed they would be a good fit for us.

Not everyone knows a financial planner in their direct circle so expand your network. Ask your friends, colleagues or do some online searching. Then set short meeting with potential candidates and ask questions.

It can feel a little like speed dating but in the end it will be worth it.

Finding someone who fits your personality, supports your goals and is eager to help you succeed are important features to look for when making your decision.

2. Know How It Works

Part of the reason I think our first financial planner didn’t work out for us, may actually be our fault.

We were a young family, lots happening as first time parents and I was scared that we’d be charged every time I wanted to talk with our planner.

We could afford it but we had so many other expenses going on that I didn’t want to spend money on “planning.”

I should have known, that’s not the case.

Financial planners don’t make their money on meetings, they make money on the success of your investments.

Maybe if I was more proactive, or if I asked more specific questions it would have worked out but at the same time, we didn’t get the outreach from them that I would have liked.

In the end, we made a switch but it’s important to understand how they make their money and you should feel comfortable reaching out to your family’s financial planner with any questions you may have.

3. Meet Regularly

The market fluctuates, you have questions, your financial picture changes, these are all great reasons for a check-in.

The more your financial planner understands your financial goals and current financial situation, the better they can support you.

We tend to meet twice a year virtually but occasionally we’ll email with questions about possible spending we’re considering or what to think about certain market changes and how they may affect us.

I no longer feel scared to reach out and it has significantly improved our saving and understanding of what we’re doing for the future.

Additionally, it has helped my wife and I stay more focused on our goals. Retiring early, having fun and enjoying time together.

4. Don’t Keep Secrets

Family financial planning only works as along as everyone is on the same page and working from the same information.

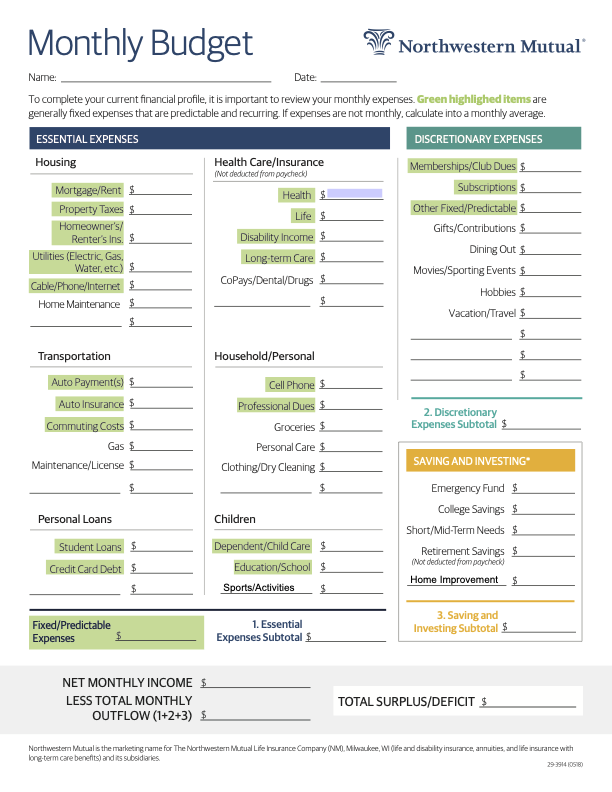

It’s important that your financial planner knows the full picture of your current expenses, savings, investments and retirement.

They are there to guide you, steer you and help you plan. Maybe even talk you off the proverbial cliff every once in a while. That only works if you’re open and honest about your current spending and saving habits and what you are aiming for in the future.

Money is one of the primary sources of friction between partners. Having an independent third person whose sole responsibility is to help you, can make those conversations much easier.

It’s totally okay for you to have both joint and separate accounts. “Fun money” is what we call our separate accounts. These accounts don’t have to be included in your planning but making sure you’re open about what spending comes from them which will be a huge argument saver in the future.

5. Follow the Advice

There’s nothing more harmful to your financial future than spending the time to meet with your financial planner and then not follow their advice.

Many of the actions necessary to implement your family’s financial plan must come from you.

Adjusting your 401k contribution, moving money between accounts, tracking down old investment information all relies on you actually following through with the necessary steps.

I know that work can be tedious but it’s well worth it. In finance, every little step matters and the longer you wait the less time you have to build wealth.

So when you have your plan, put it into action. Set a deadline, make the effort and reap the benefits of having your money work for you.

You have expenses, why not get extra points with this point accelerator card

Family Financial Planner Successes

When you have that person working for you and helping you achieve those short and long term goals, it can be incredibly rewarding.

We have been collaborating with our current family financial planner for a little over two years and we’ve felt so supported and encouraged. We’re saving more money, spending with more purpose and confident we’ll hit those long term goals.

Retirement at 60 still feels quite a ways away, but every day we’re taking steps to make that happen.

With our financial planner we can actually see the work being done to bring our dream a reality.

I am not a financial professional. The information in this post is for informational purposes only. I may receive compensation from advertisements when you click on links to those products on this page.