I’ve always been a saver but when you marry a spender you need to find balance. That’s why these (mostly) obvious money saving hacks have directly benefited our financial plans and boosted our family savings account.

Whether you’re a saver or spender at heart, it’s always good to be reminded of some money management ideas.

Especially, when the whirlwind of kids seems to upend every plan you’ve ever had and makes it seem like saving just isn’t possible.

With just about everything costing much more these days, the small things you do to save really do add up and make a difference.

While we’re spending more just for the basics than we did before, we’re also saving more money for later than we ever have.

Our goal is to retire early and enjoy life, the little things help make that happen.

If you’re considering a financial planner, these tips will help you find the right one

These Money Saving Hacks Will Stuff Your Bank Account

Whether it’s needed for an unexpected expense, saving up for a big purchase or stuffing away savings for retirement, adding up what feels like pennies now can turn into real dollars. When you see it grow each month, it can be an exciting time.

1. Know Exactly Where You’re Spending

My first money saving hack is understanding how much you’re spending and on what. Where is your money going each month?

Are you spending more on monthly bills, family needs or maybe, wants? If you can’t specifically identify how much of your money is going to different categories, it’s time to change your habits.

Getting a total picture of where your money is going is key because then you can make wise decisions.

If you’re just going by your gut or what you think sounds about right, you could be making some costly choices that would be easy to change.

If you take your monthly income (after taxes) and subtract the total of all your expenses, how much are you saving each month?

Do you have automatic savings built into those expenses?

Every month, a percentage of our take-home income is automatically divided up and transferred into three separate savings accounts.

- Short term savings – this account is for spending within a year. This could help fund a vacation, a household improvement, new toy, just as the account name suggests this money is for short term goals.

- Long term savings – pretty self explanatory but this is for long term savings. This money should be considered “off limits” for anything other than a major emergency or well-planned purchase. We have a basement amount that we don’t let this account drop below and we always have a plan to refill if we dip into it.

- End of year savings – I’m not sure about you but we get hit hard at tax season. For more than a decade, we’ve owed money come tax season. Instead of needing to pull from savings (which we’ve done) I have an account that money is put into each month for the sole purpose of using for taxes.

2. Anticipate Your Future Expenses

Knowing what you need to spend is the best way to know what you have to spend.

You may be looking at your budget for this month and think, “we’re in good shape, let’s buy that $750 eBike.”

But what you may have forgotten is next month (or in 2-3 months) you need to buy airplane tickets for the family for the holidays. Or you were thinking of doing a spring break trip with the family to the beach and need to pay the downpayment for the Airbnb.

Or maybe the car needs a repair, or if like me, you need to patch some flashing on the roof.

All those expenses add up quickly and if you’re budgeting a little bit each month for these type of expenses, you can start to have the fun things AND do the bigger expenses.

Thinking beyond right now and down the road is vitally important to saving money.

Spending you do now, impacts expenses to come. Knowing what’s coming next month or next quarter is a huge benefit to knowing what you can afford now.

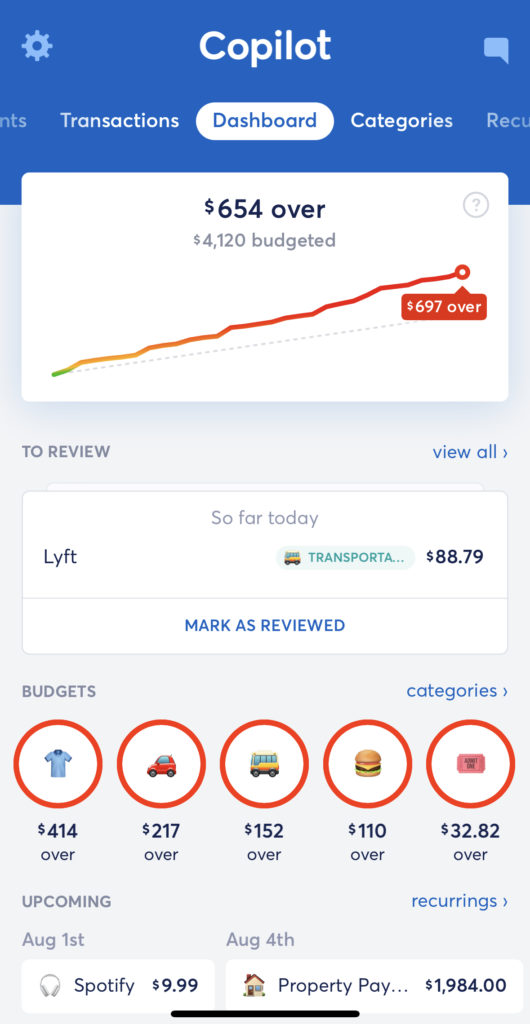

One way I keep track is through my favorite budgeting app.

3. Go Digital, Track Spending Easier

One of the best moves I made was finding an app to help me track our expenses.

The feature I love the most is the recurring charge.

These are charges that happen every month, whether the same amount each time like our mortgage or fluctuating like our Costco haul. Either way I know they’re happening every month.

The Copilot budgeting app helps me see whats happening this month and what’s around the corner, giving me a much needed window into reminding me of that upcoming $420 annual fall soccer and baseball team registration.

It’s been a game changer.

I can anticipate upcoming expenses, which helps us decide whether we should be buying something now or when the right time to buy it might be.

There are any number of budgeting and finance apps out there. I’ve tried them all.

Copilot is BY FAR the best one I’ve used. There are very few apps I use on my phone every day, this is one of them. Read my unsponsored review of the app here.

Even if Copilot isn’t your choice, find an app that works for you. It will make saving that much easier.

4. Establish Low-Budget Months

The running joke in our house is, “oh, great, it’s another low budget month.”

This isn’t necessarily a money saving hack as much as it is our way of saying, we’ve been splurging recently and it’s time to dial it back just a bit.

Maybe “splurging” isn’t the right word here. It’s more, our spending has been elevated recently, we’ve had some large expenses and we’re going to be more selective in our discretionary spending this month.

Are we still buying things? Of course.

It’s just our way of saying maybe we don’t “need” that thing and saving that money will be better in the long run.

We often know when these months are going to be (see item #5) and we can plan for them in advance.

If you aren’t looking for these low budget opportunities in your spending, I highly encourage it. It helps reset, ensure spending is on what you need, and for the things that you want, you’re building it into your plan rather than just impulsively purchasing and putting future expenses at risk.

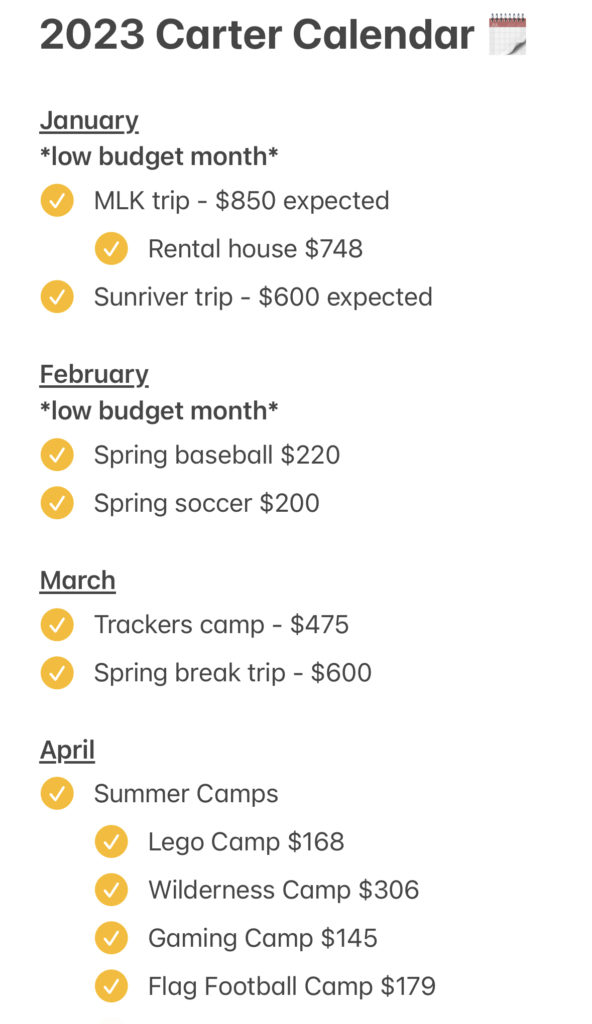

5. Create an Annual Family Spending Calendar

Sometime around the new year, my wife and I sit down and talk about what is the year going to look like? It always includes wine.

Are there any big events we need to consider, vacations we want to take, big household repairs needed, summer camps, etc.

A high level look at what we want to do and what do we need to do in the year ahead.

For us, these are all the things that are more than routine expenses that we want to anticipate. Typically any expense between $500 – $3,000.

I then attach a best-guess budget number to it. It doesn’t have to be exact but enough to get an idea of the impact it will make.

Once complete, I put all that into a shared Note on our phones broken up by month so that we can both revisit over the year.

Why does this help?

- First it sets expectations. We both agree where we’ll be spending money on bigger ticket items and know the impact it will have on our family’s finances. We’ve identified together that we both believe these to be important to us and our family, so they deserve to be spent on.

- Second, if there are disagreements on a new expense that crops up during the year, especially when one person is more in support of it than the other, you have a guide to fall back on.

Together, you can go to the existing agreed upon expenses and decide whether this new one should be an additional expense, replace an expense or just not be purchased.

The calendar limits hurt feelings, provides guardrails for both individuals and is neutral because it’s already been agreed to.

Finally, it also helps you see the total impact of the new expense because you can see all the other expenses still to come. This gives you concrete information to help guide your spending decision.

If we want to deviate from our plan, then we both have to agree it’s the right thing for our family.

How to get into the Royal Sonesta Kauai for the perfect day in paradise

Why Small Money Saving Hacks Work

There is no question saving money is always a good thing.

Saving will look different for everyone because every person and family is different.

The key thing to remember is to save at least something. Whether it’s in a savings account, retirement account, under the mattress (not recommended) or anywhere else, saving for the future can change the way you see money.

My wife and I have two different perspectives on money but knowing that we’re saving together has helped improve our communication and understanding of the other’s money motivation. We have fewer arguments because we know that we’re both trying to achieve the same thing.

Find the hacks that work for you, make a plan and execute it.

You’ll never regret it.

I am not a financial professional. The information in this post is for informational purposes only. I may receive compensation from advertisements when you click on links to those products on this page.