I have been part of the Chase credit card ecosystem since around 2010, but when we snagged the Freedom Unlimited card from Chase about two years ago, our point earning took off.

Let me explain.

You probably don’t remember Continental Airlines but back in the day, they had one of the best credit card offers around. Not to mention one of the best airlines too.

The Presidential Plus credit card from Chase was ripe with benefits and we routinely earned silver or gold status from the combination of purchases and air miles.

Then in 2012, Continental merged with United and not long after, the card benefits were diluted and eventually the Presidential Plus card was phased out for new card holders altogether.

So when I was poking around a few years ago for a card that could help accumulate points faster, I found the Freedom Unlimited card from Chase. The unlimited 1.5% cash back + the no annual fee generated immediate benefits for our family and filled our points bucket at a significantly faster pace.

Why Did We Chose the Freedom Unlimited Card?

As a family of four, with two young boys, we buy a LOT of stuff. In addition, we have sports and activity fees, subscriptions and a host of other items we spend on each month. While it may not sound like much, that extra half percent adds up and does so very quickly.

The best part, there are no special categories you have to keep track of to ensure you’re getting maximum value. Just spend and reap the benefits.

For example, both my boys do Moo Duk Kwan (Korean martial arts) at $260/month, plus a seasonal charge of $300 for baseball for one son and $195 for soccer for the other. That’s a total of $755 in one month alone for their athletics. The bonus .5% adds an extra 377 points to those charges giving us more than 1,130 points for those purchases.

This scenario plays out over and over for all our charges across all categories, allowing us to maximize our return.

Spend wiser, save more and budget better with Copilot budgeting app

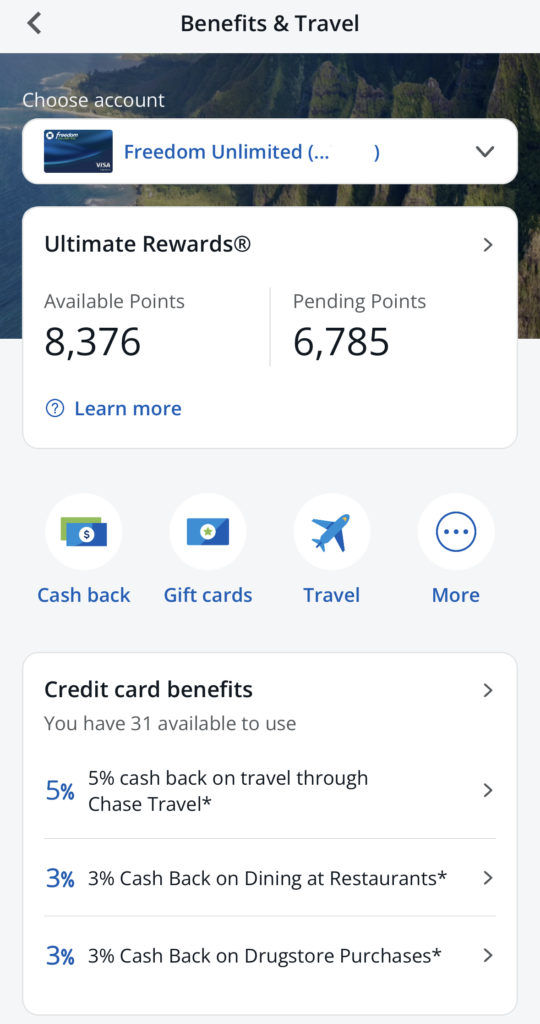

What are the Card Benefits?

In addition to the aforementioned unlimited 1.5% cash back, there are many other benefits that allow for stronger returns.

- Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

- 5% on travel purchased through Chase Ultimate Rewards.

- 3% on dining at restaurants, including takeout and eligible delivery services.

- 3% on drugstore purchases.

- 1.5% on all other purchases.

All these benefits combined, quickly deliver a sizable boost to your points to use however you’d like through the Chase Ultimate Rewards portal. The list doesn’t stop here there’s plenty more to investigate.

Added Purchase Power

If you have a Chase Sapphire card in your wallet as well, you’ve just added another 25% or 50% to your purchase power.

The Chase Sapphire cards (Preferred and Reserve) are considered a premium product that come with annual fees of of $95 or $550 respectively but can help boost your points even further.

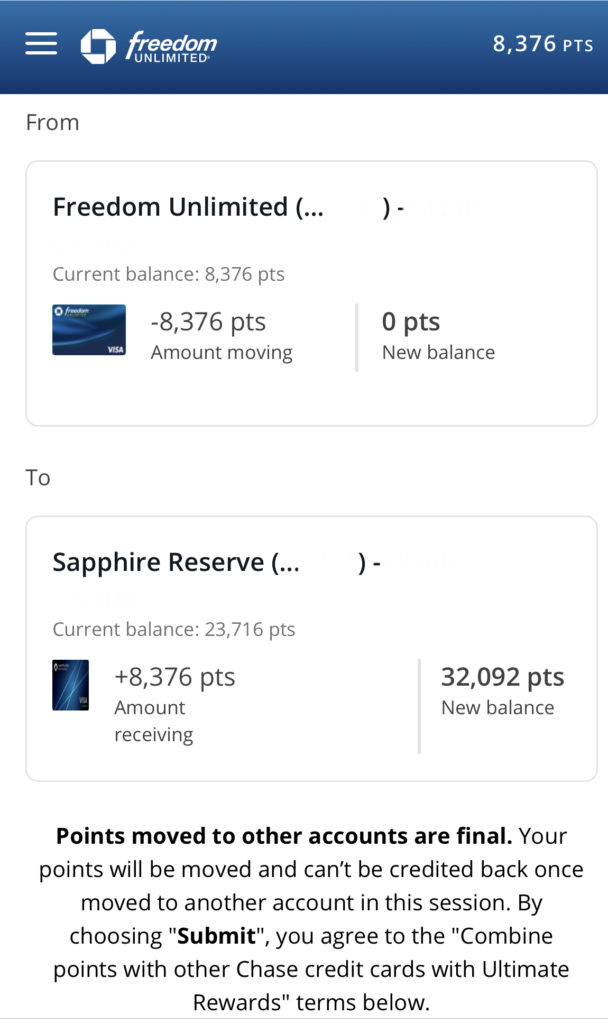

We have the Chase Sapphire Preferred card which is primarily a backup card for our day-to-day expenses. However, you can transfer your Freedom Unlimited points to your Sapphire card for free and when used through the Chase Ultimate Reward portal, you get a 25% boost.

A sneaky way Chase gets you to stay in their ecosystem.

For example, let’s say you transfer 10,000 points from your Freedom Unlimited card to your Sapphire Preferred card and then go to purchase airfare, those 10,000 points are now worth 12,500.

If you save them up month after month, that extra bonus really adds up. If you have the Sapphire Reserve that same 10,000 is now worth 15,000.

Is the Freedom Unlimited Card Right for You?

There are an infinite number of websites where you can compare credit cards from multiple issuers. I’m not that kind of site. But what I can tell you is we’ve seen a significant bump in point accumulation when we added the Freedom Unlimited card to our portfolio.

While we choose to pay off the balance each month, there is a 0% intro APR for 15 months from account opening on purchases and balance transfers. After the intro period, there is a variable APR of 20.24%–28.99%.

It is our go-to card for all of our daily purchases and when we’re looking at holiday travel, combined with the 25% boost from our Sapphire Preferred card it can equate up to one entire plane ticket.

To me that’s money in the bank and a great way to make your everyday purchase work for you.

This is not a sponsored post and I am not a financial professional. The information in this post is for informational purposes only. I may receive compensation from advertisements when you click on links to those products on this page.